Why is it important to have a strong password?

It is important to have a strong password on your accounts to keep them private and secure and also to prevent any unauthorised access which could lead to you becoming the victim of financial fraud and identity theft.

How secure is your password?

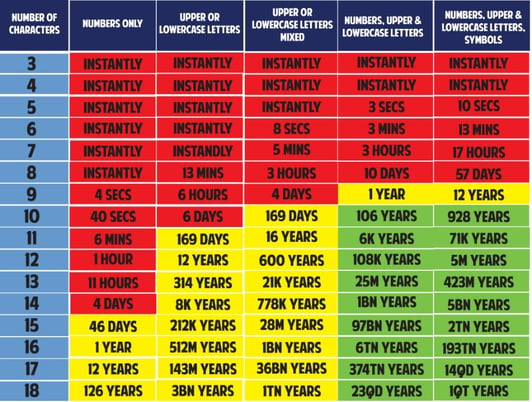

Did you know that with the latest graphic processing technology a seven-character password can be cracked in 31 seconds?

One with six or fewer characters could be cracked instantly, whereas one with 18 characters comprising of numbers, upper and lowercase letters and symbols would take 438 trillion years to crack.

Repeatedly using the same password or using a weak password such as a short one that only contains numbers or lowercase letters will make your accounts more accessible to hackers. The more complex your password is, the more secure your accounts will be.

This chart from stlcom.com shows just how easy it can be to crack a password.

Our tips for creating a strong password and keeping it safe:

- Don’t use your name, family members' names or important dates such as your birthday

- Don’t use the word ‘password’ or variations of it such as pa55w0rd

- Don’t write down password(s) or any security information unless this is done in a way that would make it impossible for anyone else to recognise any of that information

- Don’t disclose passwords or any security information, or make them available to anyone else, either by telling someone else or by entering them in a way that allows other people to see them

- Have different passwords for each of your accounts

- Use long passwords

- Include a mix of numbers, symbols and upper and lowercase letters

- Never send passwords in emails, text messages or on social media.

Having a secure password is essential, however, it is not always enough to stop an unauthorised attack on your account. A hacker could randomly guess your password or use phishing techniques where fraudsters send you emails or text messages posing as legitimate companies trying to get you to click on links and provide your personal details to gain access to your accounts.

Remember, OnePay will never ask you for your personal banking details for example your password or your PIN by letter or email. If we do contact you by phone, we may need to identify you by asking you certain information known only by you.